In our role of promoting monetary stability, Bank Negara Malaysia seeks to implement a monetary policy that maintains a low and predictable pace of increase in the general level of prices of goods and services, taking into consideration economic developments and the outlook. Ultimately, the aim is to promote monetary stability that is conducive to the sustainable growth of the Malaysian economy.

Key Monetary Stability Indicators

| Headline Inflation (September 2025) |

1.5% |

| GDP Growth (3rd Quarter 2025) |

5.2% |

Next Decision Date

22 January 2026 (Thursday)

In Malaysia, the responsibility for formulating and implementing monetary policy is entrusted to BNM as the nation’s central bank. The Central Bank of Malaysia Act 2009 states that one of the principle objects of BNM is to promote monetary stability conducive to the sustainable growth of the Malaysian economy.

In promoting monetary stability, BNM is mandated to pursue a monetary policy which serves the interests of the country with the primary objective of maintaining price stability while giving due regard to the developments in the economy.

BNM, through its Monetary Policy Committee (MPC), executes its monetary policy responsibility by adjusting its policy interest rate (Overnight Policy Rate, or OPR). The OPR is the sole indicator used to signal the stance of monetary policy, and is announced through the Monetary Policy Statement (MPS) released after the MPC meeting.

The Monetary Policy Committee

Under the Central Bank of Malaysia Act 2009, the Monetary Policy Committee (MPC) of BNM is responsible for formulating monetary policy and policies for the conduct of monetary policy operations. The Act also provides for the appointment of external members to the MPC.

The MPC comprises the Governor, the Deputy Governors, and not less than three but not more than seven other members, including external members who are appointed by the Minister of Finance upon the recommendation of BNM's Board Governance Committee. The membership of the MPC seeks to bring together a diversity of expertise and experience that is critical for sound decision-making on monetary policy

One of the main responsibilities of the MPC is to decide on the appropriate level of the policy interest rate, the Overnight Policy Rate, which serves as the sole signal of BNM’s monetary policy stance. The present monetary policy framework was introduced in April 2004.

Apart from the overnight rate, BNM does not directly influence the level of other short-term and long-term interest rates and bond yields. These rates are determined by the financial markets.

Monetary Policy FAQs

- Monetary policy is the action that Bank Negara Malaysia (BNM) takes to influence interest rates in the economy. As the central bank of Malaysia, BNM’s role is to promote monetary and financial stability. This is aimed at providing the conditions suitable for sustainable growth of the Malaysian economy. To achieve monetary stability, our Monetary Policy Committee (MPC) sets monetary policy to keep inflation low and stable while supporting economic growth.

- The MPC sets monetary policy by changing the Overnight Policy Rate (OPR). The OPR is BNM’s policy interest rate that influences, among others, banks’ lending and financing rates, as well as deposit rates. These rates tell you how much the cost of loan is, or how much the returns are for deposits. They are applicable for both conventional and Islamic finance products. To keep things simple, we refer to these as ‘interest rates’ for this FAQ.

- Changes in the OPR affect economic activity and overall price level changes, typically by influencing interest rates in the economy.

- When we increase the OPR, higher interest rates on savings and loans will influence people to save more and spend less. For example, when the demand for goods and services in the economy is more than the supply available, prices will keep rising. People will pay more to buy what they want. The higher OPR will help to slow demand down. This brings demand more in line with supply and prices would increase more slowly.

- The reverse happens when we reduce the OPR. Lower interest rates on loans and savings will get people to save less and spend more. This spurs economic activity and avoids a situation of falling price levels due to weak demand, which will hurt the economy.

- Inflation is a measure of how much the overall level of prices of goods and services in the economy has changed over a period of time. One way to do this is by comparing the cost of things today against how much they were a year ago.

- Every month, the Department of Statistics Malaysia (DOSM) collects the prices of a basket of over 500 items from around 21,800 retail outlets across the country. They use this basket to compute the Consumer Price Index (CPI). Inflation is measured by comparing the change in CPI over time.

- The CPI basket is made up of goods and services which reflect the average spending patterns of Malaysian households. The items include food, fuel, clothing, restaurant meals, and leisure activities, among others. To develop the basket, DOSM conducts the Household Expenditure Survey periodically, typically every two to three years, to understand households’ spending patterns. For example, on average, 29.5% of households’ spending is on food and non-alcoholic beverages compared to 3.2% on clothing and footwear (based on existing CPI weights set in 2018). This means that food and non-alcoholic beverages have a higher weight in the CPI, and so any change in food prices would have a larger impact on inflation.

- The monthly CPI releases are published on DOSM’s website: https://www.dosm.gov.my/v1/index.php.

- When inflation is low and stable, it means that changes in the overall level of prices are stable and predictable. This is important because if prices keep changing and are hard to predict, it is difficult for households and businesses to plan how much they can spend, save or invest. This will then affect economic activity and growth.

- When price increases go out of control, it hurts your purchasing power. High and volatile inflation affects everyone, but it hurts lower-income households the most. Compared to the higher-income group, a larger share of their spending is on essential purchases like food and housing.

- High inflation also makes it harder for businesses, which may face higher costs to produce goods and services, or lower sales if the high prices affect consumers’ demand. This can then affect business sales and profits. When prices keep changing, businesses also find it difficult to plan and invest for the future.

- For savers and retirees, high inflation also eats into your savings. Rapid increases in prices will quickly erode the purchasing power of your savings.

- Having a long period where overall prices are falling is not good for the economy either. This is known as deflation, which is bad when it is due to a collapse in demand. When this happens, many people lose their jobs and there is more uncertainty and financial stress. As a result, there would be lower investment and spending. Businesses would have to cut prices to attract consumers, but people would not spend as their finances are uncertain and they wait for prices to come down more. Like high inflation, deflation is also harmful to the economy.

- Economic growth happens when the size of the economy increases over time. The size of an economy is usually measured by the total production of goods and services in the economy. This is also known as the gross domestic product (GDP).

- Sustainable growth is the rate at which the economy can keep growing at a steady pace over a long period. For some, it may appear to be a good idea to raise economic growth today, beyond the sustainable pace. This is like sprinting too hard in a marathon. You may pull ahead for a short while, but you will also quickly lose steam and might not even finish the race.

- So, it is more important to have growth that can be maintained without causing other problems. We have seen how growth that is too high or driven by cheap credit can damage the economy badly, such as in countries which faced extremely high inflation. When this happens, it is the people, including future generations, who will pay the costs and be left poorer. Having sustainable growth helps to temper such a boom and bust cycle.

- So, we balance both short and long-term aims in our policies to make sure growth is sustainable. Sometimes, this means being careful to avoid policies that could deliver high growth today but can cause growth to crash in the future.

- The MPC’s aim is to maintain low and stable inflation while promoting sustainable growth. Thus, when deciding on the OPR, we look at risks to both inflation and growth in Malaysia.

- We always look ahead when we set monetary policy because the effects of OPR changes on economic activity and inflation do not happen right away. According to some estimates, it usually takes about one year for monetary policy to have the most effect on the economy. This is because it takes time for households and businesses to change their behaviours.

- The MPC meets at least six times a year to set monetary policy. We announce our decisions on monetary policy after each MPC meeting through the Monetary Policy Statement (MPS)..

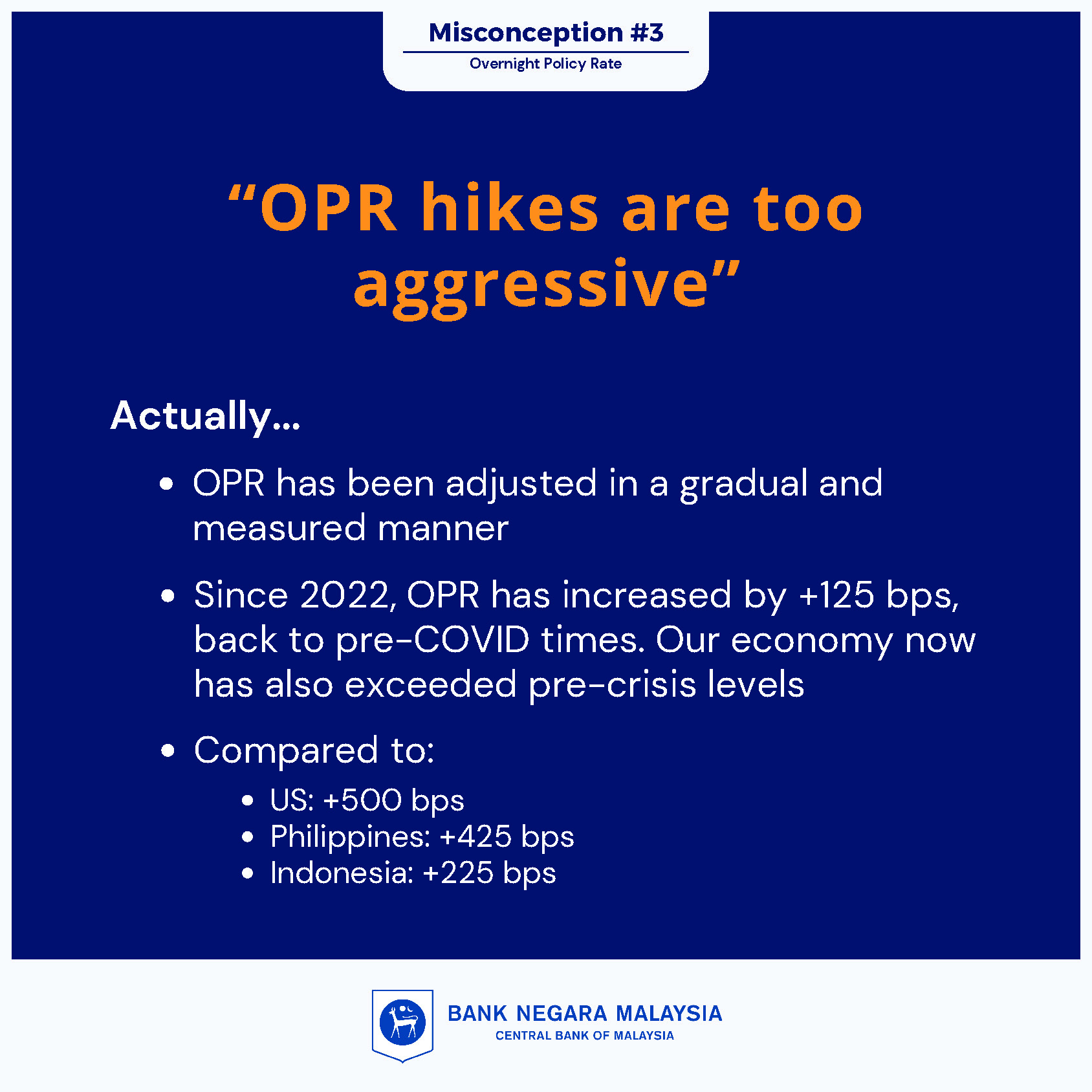

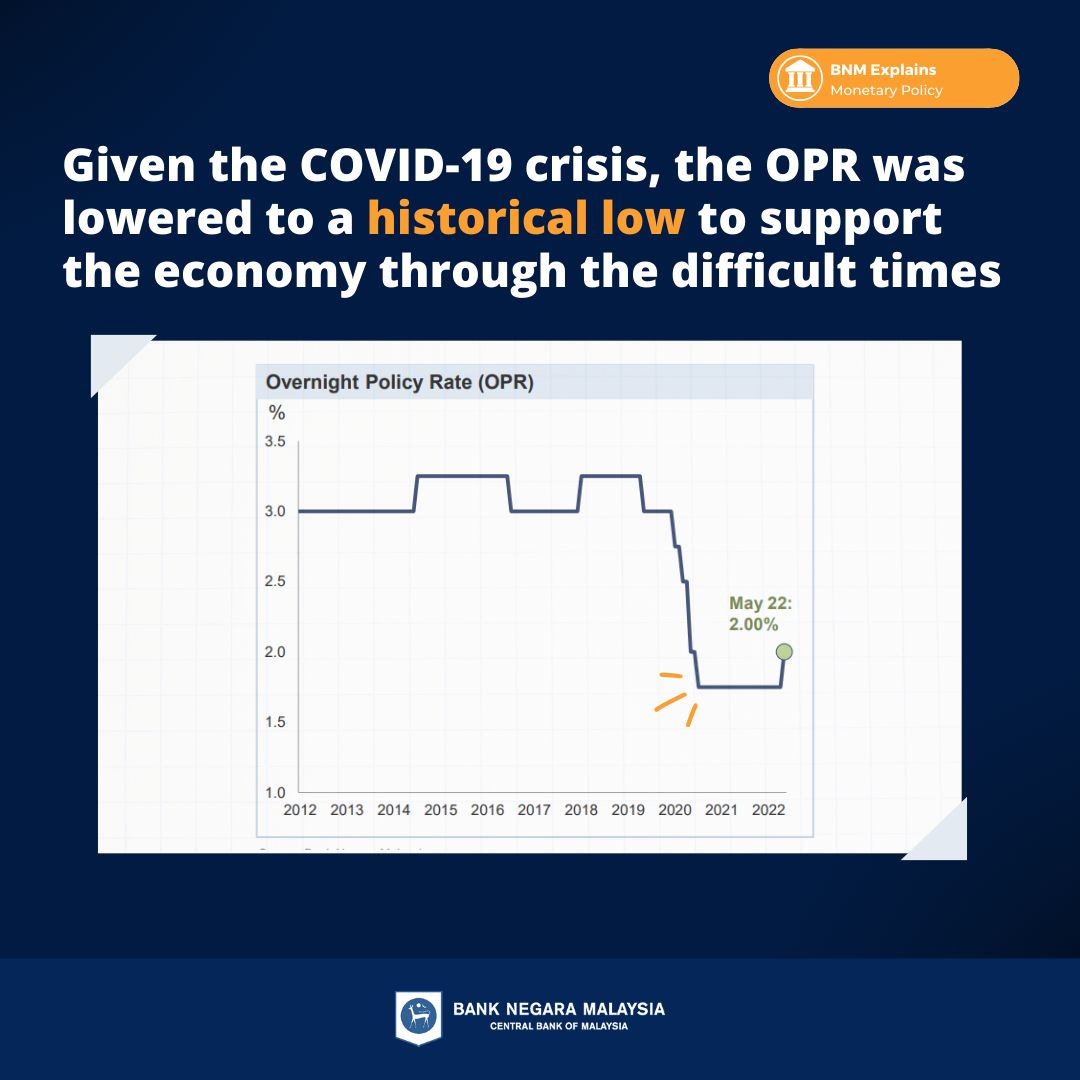

- We set the OPR to influence the pace of economic activity and inflation. Since the OPR was introduced in 2004, we have adjusted the OPR many times, both upwards and downwards, based on what the economy needs.

- The OPR was the highest at 3.50% in April 2006. During that time, the economy was growing steadily, CPI inflation was at 4.6% and a higher OPR was needed to manage the risk of higher prices.

- The OPR was the lowest at 1.75% from July 2020 until May 2022 to support the economy during the COVID-19 pandemic. In tough times, low interest rates make borrowing cheaper and lowers the returns on savings. This spurs spending, boosts investments and protects jobs and income in times of crisis.

- You can look at our OPR decisions over time, including the reasons for the decisions here.

- Most central banks globally, including Malaysia, use interest rates as their monetary policy tool. However, some countries like Singapore and Hong Kong use the exchange rate as their monetary policy tool. The choice of monetary policy tool would depend on the economic characteristics of the country, for example, how much a country imports and the degree of openness to capital flows.

- In our case, imports account for a relatively small share of what Malaysian households spend on and invest in, so an exchange rate appreciation may not effectively mitigate inflation shocks. Managing inflation requires a tool that can directly influence domestic demand, which is why the MPC uses the OPR to set monetary policy. Read more about how the change in OPR influences demand which in turn affects inflation under FAQ number 2: What happens when we change the OPR?

- This policy also allows us to manage the domestic interest rate along with free capital movement and a flexible exchange rate. Click here to read more.

- Changes in interest rates are intended to encourage people to adjust their borrowing, saving, investment, and spending decisions.

- If you are planning to take out a new loan, borrowings could become more expensive or cheaper for you depending on the interest rates. If you have an existing loan, the effect depends on the type of loan that you have.

- Fixed-rate loans will be unaffected. The amount you pay to your bank will remain exactly the same. Typically, this applies to car loans.

- If you have a floating-rate loan, your borrowing costs will change. This means your monthly instalment will be higher or lower depending on whether the OPR increases or decreases. Typically, this will affect housing loans and some personal loans. For individual borrowers, the interest rate on your loan will increase or decrease by the exact same rate of change in the OPR. For example, if the OPR is increased by 25 basis points, the interest rate on your housing loan, if previously at 3.50%, will also increase to 3.75%. Your loan instalment will increase with the higher interest rate. Conversely, a reduction in the OPR by 25 basis points may lower your rate to 3.25%.

- In any case, your bank must inform you accordingly on changes to your loan repayments. You will receive a notification from your bank spelling out how your repayment amount will change (either via mail, email, SMS or applications). This will clearly outline your latest interest rate, new repayment amount and when it will take effect, so that you can prepare accordingly. While this notice may not reach you immediately after an OPR change, banks are required to ensure it reaches you at least seven calendar days before the new instalment amount is due for payment.

- Read more about this in the Reference Rate Framework policy document and Consumer Guide on Reference Rate Framework.

- If you have any concerns or notice unexpected changes to your instalment, you are encouraged to first contact your bank(s) for clarification. Should you want to pursue the matter further upon hearing from your bank(s), you may then reach out to Bank Negara Malaysia for further assistance.

- It is important to understand how a change in interest rates could affect your ability to pay. You can use a home loan calculator that is available online to work out your new monthly instalments, such as this.

- Aside from loans, interest rates also affect your savings. When interest rates go up, you may earn higher returns on your savings. Subsequently, when interest rates go down, the returns on your savings may be lower. You might notice this in lower fixed deposit rates or reduced earnings on your regular savings.

- When the OPR changes, banks may adjust the interest rates on the funds that savers deposit in banks.

- The OPR influences interest rates on savings and borrowings, but other factors matter too.

- For new loans, the interest rate charged by banks also depends on a borrower’s ability to pay instalments, as well as banks' operating costs, market competition and other business considerations. For example, if you have a good repayment track record, you may enjoy a lower interest rate on your new borrowings, compared to others.

- If you have an existing floating-rate loan (e.g., a floating-rate housing loan), the interest rate on the loan will move in line as the OPR. Whenever the OPR changes, your new loan instalment amount will take effect anytime within three months.

- For savings, deposit rates also depend on factors such as competition among banks for funding, alternative sources of lower-cost funding available to banks, and other business considerations including lending strategies. These factors could see interest rates on savings changing more or less than changes in the OPR. Returns on deposits placed with banks also depend on the type of deposits, such as whether you are placing your money in a current and savings deposit account, or a fixed deposit account. Returns on current and savings deposit account are usually much lower and less sensitive to movements in the OPR. This is because the main purpose of these accounts is to allow you to make transactions and the money in these accounts can be withdrawn at any time.

- Generally, monetary policy is intended to affect the economy as a whole. This is what makes it effective to keep the economy healthy.

- Borrowers should be aware that repayments for floating-rate loans will change if the OPR changes and consider whether they can afford the loan if the interest rates were to increase.

- Having said that, if you are an existing borrower with fixed-rate loans, you will not face changes in interest rates for the loans you currently have.

- We understand that the increase in interest rates may be more difficult to handle for some. Help is available. If you are having trouble repaying your monthly loan instalments, the best thing you can do is get in touch with your banks or the Credit Counselling and Debt Management Agency (Agensi Kaunseling & Pengurusan Kredit, AKPK) as soon as you can to learn about the support options available.

- You can also ask your bank for repayment options that suit your current financial situation (e.g. to retain the same instalment amount temporarily). Your banks will explain the implications of the repayment options to you. This may include changes to the total cost of borrowing, changes in the length of your loan tenure or additional interest amount you need to repay. You can revise your instalment amount upwards once your financial situation improves to reduce the overall cost of borrowing in the future.

BNM influences the domestic interest rates via the policy interest rate, the Overnight Policy Rate (OPR). The MPC of BNM decides on whether the OPR is at an appropriate level to maintain price stability while supporting economic activity.

The OPR serves as the target rate for the day-to-day liquidity operations of BNM. Monetary operations by BNM are undertaken by ensuring an appropriate level of liquidity is in the banking system to influence the average overnight interbank rate (AOIR) to remain around the OPR. This in turn sets guidance for other interest rates in the economy, including the interest rates on consumer and business loans and deposits which will then affect savings and spending decisions of households and businesses. By adjusting the OPR, changes in the broad range of interest rates through various monetary transmission channels will, thus, influence the pace of economic activity and inflation.

To prevent excess volatility in the AOIR, BNM has also put in place an interest rate corridor of ±25 basis points around the OPR and standing facilities. BNM provides a lending facility and a deposit facility for the interbank institutions at the ceiling and floor rates of the corridor, respectively.

The OPR serves as the target rate for the day-to-day liquidity operations of BNM. Monetary operations by the Bank are undertaken by ensuring an appropriate level of liquidity is in the banking system to influence the average overnight interbank rate (AOIR) to remain around the OPR. This in turn sets guidance for other interest rates in the economy, including the interest rates on consumer and business loans and deposits which will then affect savings and spending decisions of households and businesses. By adjusting the OPR, changes in the broad range of interest rates through various monetary transmission channels will, thus, influence the pace of economic activity and inflation.

To prevent excess volatility in the AOIR, BNM has also put in place an interest rate corridor of ±25 basis points around the OPR and standing facilities. BNM provides a lending facility and a deposit facility for the interbank institutions at the ceiling and floor rates of the corridor, respectively.

For more information, please refer to the Monetary Operations page in the Financial Markets section.

See also: All OPR Decisions

To promote monetary stability, the MPC determines the direction of monetary policy based on its assessment of the balance of risks to the outlook for both domestic growth and inflation. The MPC also monitors risks of destabilising financial imbalances given their implications for the prospects of the economy.

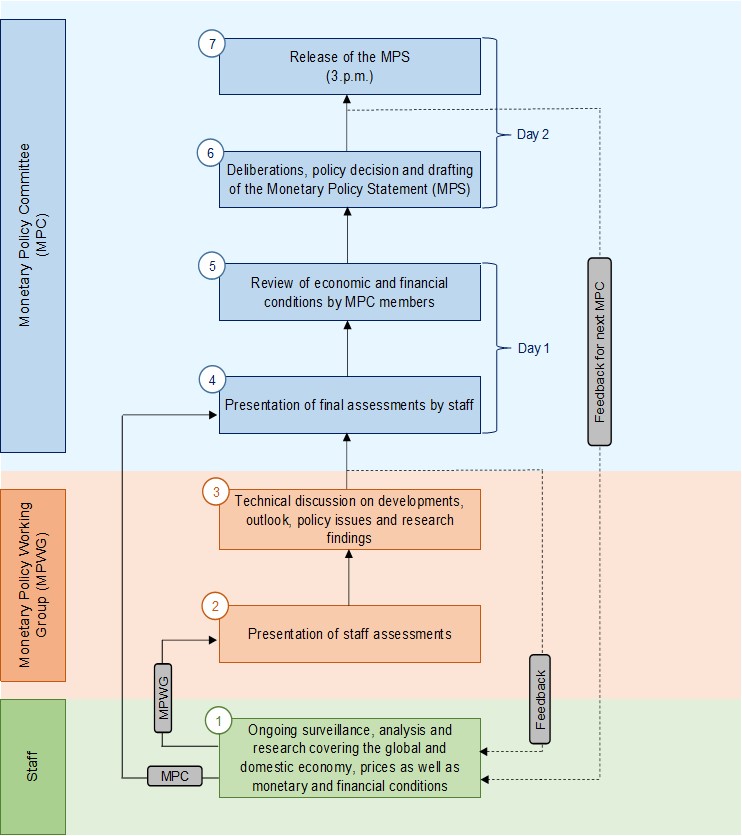

The Committee meets at least six times a year to decide on the OPR and publishes the Monetary Policy Statement (MPS) following each meeting to explain its decisions.

An integral part of the monetary policy decision-making process is the internal processes leading up to the MPC meeting. In this regard, the Monetary Policy Working Group (MPWG) plays an essential role.

The MPWG was established in 2002 as an internal forum to discuss staff assessments on the latest economic, monetary and financial market developments and outlook, policy issues and research findings before the presentations are prepared for the MPC.

Apart from its quality control function, the MPWG also ensures that the views of all relevant parts of BNM are taken into account and considered carefully. The MPWG is chaired by the Assistant Governor in charge of the economics sector.

For more information, refer to the BNM Annual Report 2015 box article entitled 'Evolution of the Monetary Policy Committee of Bank Negara Malaysia: Key Milestones over the Years'.

An integral part of the monetary policy decision-making process is the internal processes leading up to the MPC meeting. In this regard, the Monetary Policy Working Group (MPWG) plays an essential role.

The MPWG was established in 2002 as an internal forum to discuss staff assessments on the latest economic, monetary and financial market developments and outlook, policy issues and research findings before the presentations are prepared for the MPC.

Apart from its quality control function, the MPWG also ensures that the views of all relevant parts of the Bank are taken into account and considered carefully. The MPWG is chaired by the Assistant Governor in charge of the economics sector.

For more information, refer to the BNM Annual Report 2015 box article entitled 'Evolution of the Monetary Policy Committee of Bank Negara Malaysia: Key Milestones over the Years'.